by wadminw on April 18, 2023

These accounts carry their ending balances into the next accounting period and are not reset to zero. All expense accounts are then closed to the income summary account by crediting the expense accounts and debiting income summary. If your revenues are greater than your expenses, you will debit your income summary account and credit your retained earnings account.

Then, just pick the specific date and year you want the closing process to take place, and you’re done! In just a few clicks, the entire financial year closing is streamlined for you. That’s why most business owners avoid the struggle by investing in cloud accounting software instead.

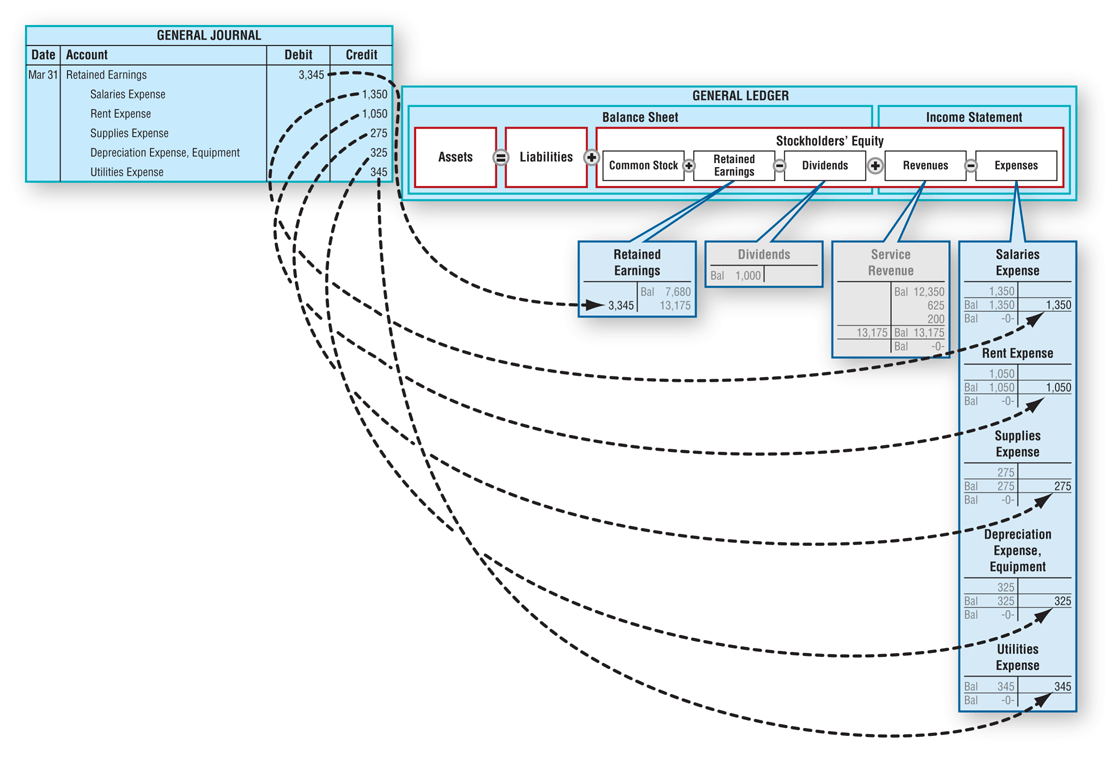

Closing entries are put into action on the last day of an accounting period. There are various journals for example cash journal, sales journal, purchase journal etc., which allow users to record transactions and find out what caused changes in the existing balances. Closing entries are mainly used to determine the financial position of a company at the end of a specific accounting period. Income summary effectively collects NI for the period and distributes the amount to be retained into retained earnings.

The third entry requires Income Summary to close to the RetainedEarnings account. To get a zero balance in the Income Summaryaccount, there are guidelines to consider. Let’s explore each entry in more detail using Printing Plus’sinformation from Analyzing and Recording Transactions and The Adjustment Process as our example.

Finally, transfer any dividends to the retained earnings account. A closing entry is a journal entry that’s made at the end of the accounting period that a business elects to use. It’s not necessarily a process meant for the faint of heart because it involves identifying and moving numerous data from temporary to permanent accounts on the income statement. When making closing entries, the revenue, expense, and dividend account balances are moved to the retained earnings permanent account. If you own a sole proprietorship, you have to close temporary accounts to the owner’s equity instead of retained earnings.

In other words, the income and expense accounts are “restarted”. It is also possible to bypass the income summary account and simply shift the balances in all temporary accounts directly into the retained earnings account at the end of the accounting period. The second entry requires expense accounts close to the IncomeSummary account. The expense accounts have debit balances so to get rid of their balances we will do the opposite or credit the accounts. Just like in step 1, we will use Income Summary as the offset account but this time we will debit income summary.

Now, it’s time to close the income summary to the retained earnings (since we’re dealing with a company, not a small business or sole proprietorship). Expense accounts have a debit balance, so you’ll have to credit their respective balances and debit income summary in order to close them. This time period, called the accounting period, usually reflects one fiscal year.

This involved reviewing, reconciling, and making sure that all of the details in the ledger add up. With the use of modern accounting software, this process often takes place automatically. Nigel Sapp is a content marketer at Numeric, partnering with top accountants to break down best practices, thorny accounting topics, and operating income formula helping teams navigate the world of accounting tech. Like a well-oiled engine, a solid month-end close keeps your finances running smoothly and your business in the fast lane. Tasks like data entry, reconciliation, and reporting benefit greatly from automation tools, allowing your team to focus on more strategic activities.