by wadminw on January 18, 2021

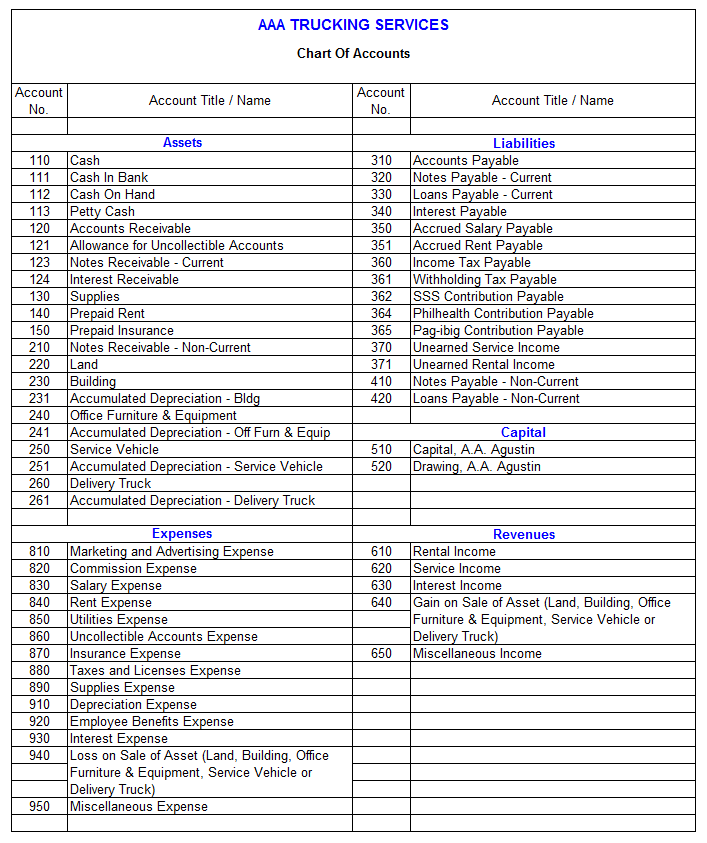

In this sample chart of accounts template the sub-group column divides each group into the categories shown in the listings below. The purpose of the sub-group is to categorize each account into classifications that you might need to present the balance sheet and income statement in accounting reports. A simple structure allows you to easily identify accounts and helps in the posting of transactions and the preparation of the trial balance and financial statements. It is usually best to use numbers for account codes as this will speed up the process of entering transactions as the numeric key pad can be used. Current assets, or short-term assets, include cash and other resources that are expected to be liquidated or turned into cash within one year or one operating cycle, whichever is longer.

Incorporate your newly created COA into your accounting software or manual accounting system. This might involve setting up each account within the software category:computer file systems wikipedia and ensuring that it aligns with your COA structure. Run a series of transactions through your COA to test its functionality and practicality.

The trial balance is helpful to see all the accounts on one report and is used mainly at the financial year-end. The accounts are identified with unique account numbers, and are usually grouped according to their financial statement classification. A chart of accounts lists down all accounts used by an entity in its accounting system.

In this ultimate guide, not only do we explore examples of a common chart of accounts but also we discuss best practices on how to properly set up your chart of accounts. In summary, a well-designed Chart of Accounts is crucial to an organization’s financial success. By having a clear understanding of the COA’s purpose, structure, and organization, businesses can maintain accurate financial records and make informed decisions based on reliable data. Having a Chart of Accounts allows businesses to easily track their financial transactions, generate meaningful financial reports, and maintain compliance with applicable regulations.

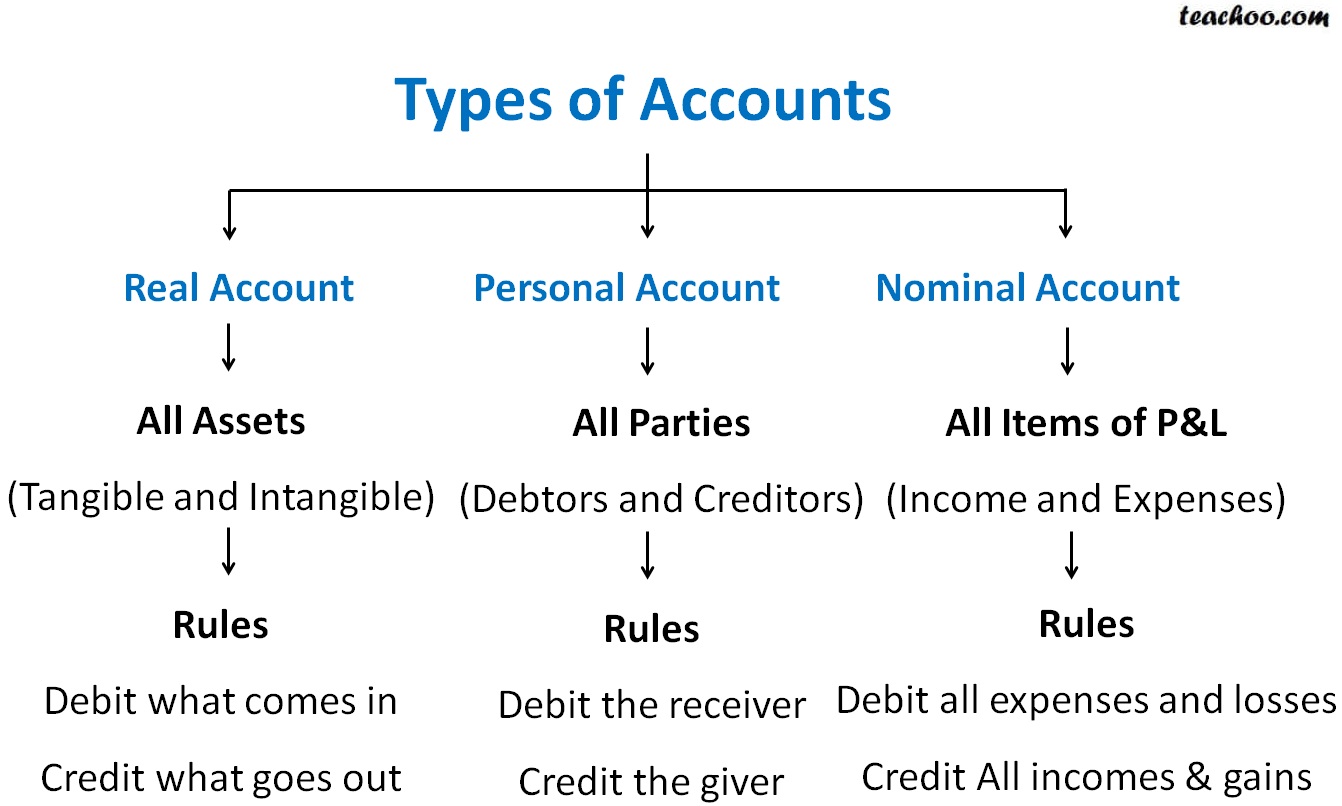

For example the inventory codes run from 400 to 499 so there is plenty of room to incorporate new categories of inventory if needed. The business should decide what accounting reports it needs and then provide sufficient account codes to allow the report to be produced. The chart of accounts often abbreviated to COA, is the foundation of the double entry bookkeeping system. It is basically a listing of all the accounts found in the general ledger that the business will use to code each bookkeeping transaction. This sample chart of accounts provides an example using some of the most commonly found account names. For example, if a company makes a sale, it debits an asset account (like Accounts Receivable or Cash) and credits a revenue account (Sales Revenue), as defined in the COA.

It generally helps to keep the most used accounts towards the top of each group as this helps speed up locating the account and the posting of double entry transactions. Take note, however, that the chart of accounts vary from company to company. The contents depend upon the needs and preferences of the company using it. First, let’s look at how the chart of accounts and journal entries work together. Equity accounts will vary significantly based on the structure of the business.

It typically includes asset, liability, equity, income, and expense accounts. A chart of accounts is a document that numbers and lists all the financial transactions that a company conducts in an accounting period. The information is usually arranged in categories that match those on the balance sheet and income statement. The main accounts within your COA help organize transactions into coherent groups that you can use to analyze your business’s financial position. In fact, some of the most important financial reports — the balance sheet and income statement — are generated based on data from the COA’s main accounts. The COA is the financial framework of any business, crucial for accurate financial documentation and analysis.

You use a COA to organize transactions into groups, which in turn helps you track money coming in and out of the company. Income is often the category that business owners underutilize the most. Some of the most common types of revenue or income accounts include sales, rental, and dividend income. Size – Set up your chart to have enough accounts to record transactions properly, but don’t go over board.

There are a few things that you should keep in mind when you are building a chart of accounts for your business. As you can see, each account is listed numerically in financial statement order with the number in the first column and the name or description in the second column. The sample chart of accounts template will help you to produce your own chart of accounts, and is available for download in Excel format by following the link below. He frequently speaks at continuing education events.Charles consults with other CPA firms, assisting them with auditing and accounting issues. The account’s unique identifier (e.g., 1010.1) is used to specify where the debit or credit is to be recorded.