by wadminw on October 27, 2021

Each Square account has potentially different terms based on its history and trends. When notes are sold with conditions, the company creates contingent liability, and it is disclosed in the notes to financial statements. As mentioned depreciation tax shield calculation earlier, if Anchor used IFRS the $480 discount amount would be amortized using the effective interest method. If Anchor used ASPE, there would be a choice between the effective interest method and the straight-line method.

For example, on November 1, the company ABC receives a $10,000 promissory note from one of its customers in exchange for the goods it sells to that customer. The promissory note has a maturity of 3 months, in which it will be honored by the customer after 3 months pass. Note that in this calculation we expressed the time period as a fraction of a 360-day year because the interest rate is an annual rate and the note life was days. Frequency of a year is the amount of time for the note and can be either days or months. We need the frequency of a year because the interest rate is an annual rate and we may not want interest for an entire year but just for the time period of the note.

Time represents the number of days (or other time period assigned) from the date of issuance of the note to the date of maturity of the note. (a)”One year after date, I promise to pay…” When the maturity is expressed in years, the note matures on the same day of the same month as the date of the note in the year of maturity. If the note receivable is due within a year, it’s treated as a current asset, treated as non-current assets. As shown above, the note’s market rate (12%) is higher than the stated rate (10%), so the note is issued at a discount.

For information pertaining to the registration status of 11 Financial, please contact the state securities regulators for those states in which 11 Financial maintains a registration filing. The ability to raise cash in this way is important to small and medium-sized businesses, which may have limited access to finance. It is possible to combine the previous two entries by debiting Notes Receivable and crediting Sales. Together, the principal and interest portions represent the note’s maturity value.

This balance represents 89 days [30 days in January, 28 days in February, 31 days in March] of the the 90 day note. Accounts Receivable is a normal business transaction for between a company and its customer. The intent is for the debt to be settled in the normal course of business, usually in 30 days (depending on the terms of the account.) It typically does not have an interest rate.

Notes can be converted to cash by discounting them to the financial institutions. If the maker dishonors the note, the company discounting the note pays to the financial institutions. Below are some examples with journal entries involving various stated rates compared to market rates.

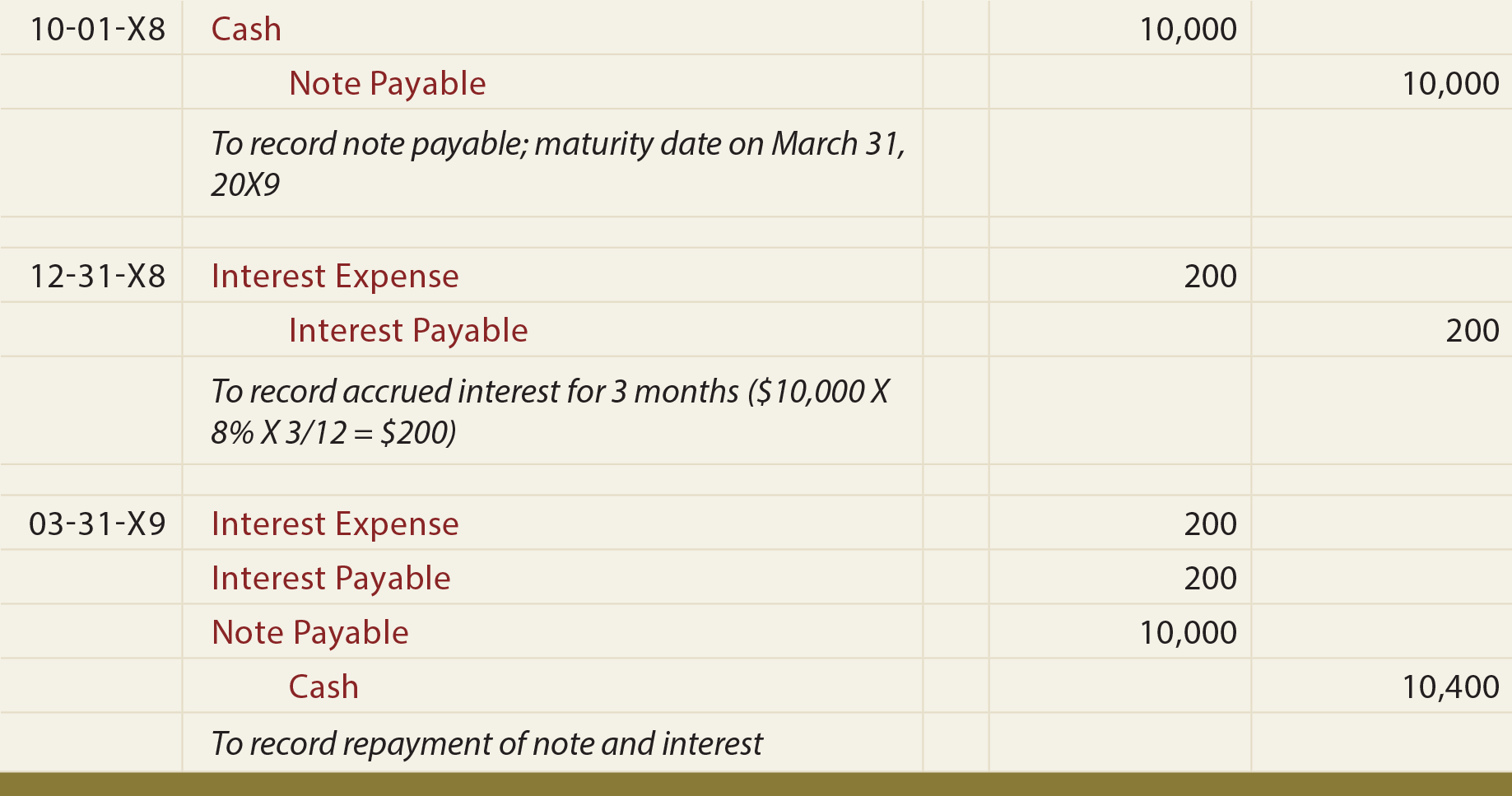

The date on which the security agreement is initially established is the issue date. A note’s maturity date is the date at which the principal and interest become due and payable. For example, when the previously mentioned customer requested the $2,000 loan on January 1, 2018, terms of repayment included a maturity date of 24 months. This means that the loan will mature in two years, and the principal and interest are due at that time. The following journal entries occur at the note’s established start date. A note receivable is a written promise to receive a specific amount of cash from another party on one or more future dates.

Remember from earlier in the chapter, a note (also called a promissory note) is an unconditional written promise by a borrower to pay a definite sum of money to the lender (payee) on demand or on a specific date. A customer may give a note to a business for an amount due on an account receivable or for the sale of a large item such as a refrigerator. Also, a business may give a note to a supplier in exchange for merchandise to sell or to a bank or an individual for a loan.

In some cases, the term of the note is expressed in days, and the exact number of days should be used in the interest computation. In this example, interest is based on the fact that the note has been outstanding for 62 days. This period of time is important in calculating the interest charges related to the notes. A case in point is the sale of equipment or other personal or real property in which payment terms are normally longer than is customary for an open account.

For example, a company may have an outstanding account receivable in the amount of $1,000. The customer negotiates with the company on June 1 for a six-month note maturity date, 12% annual interest rate, and $250 cash up front. Notes receivable can convert to accounts receivable, as illustrated, but accounts receivable can also convert to notes receivable. The transition from accounts receivable to notes receivable can occur when a customer misses a payment on a short-term credit line for products or services. In this case, the company could extend the payment period and require interest.

Essentially, in all these situations, the company that owns the receivable either sells it to the bank (or another lender) or borrows against it to obtain immediate cash. Subsequently, if the accounts receivable prove uncollectible, the amount should be written off against the Allowances account. When the borrower or maker of a note fails to make the required payment at maturity, the note is considered to have defaulted. In other cases, a customer’s credit rating may cause the seller to insist on a written note rather than relying on an open account. The individual or business that signs the note is referred to as the maker of the note.